The IRS doesn’t allow 1031 exchanges for primary homes. This tool is reserved for deferring capital gains taxes on investment or commercial properties.

But fear not! The Internal Revenue Code (IRC) offers exceptions that could still benefit homeowners eyeing a 1031 exchange for their primary abode.

Under Section 121 of the IRC, certain individuals may dodge capital gains tax when swapping a primary residence for another home or investment property. To qualify, homeowners must have owned the property for at least five years, with two of those years spent living in it.

However, there’s a catch: the property must also serve as an investment asset, with the intention of using the replacement property for business or investment purposes. Therefore, meticulous documentation to prove this intent is crucial for tax filing, ensuring compliance with IRC §1031 requirements.

Using a Primary Residence for a 1031 Exchange

Typically, the IRS doesn’t allow investors to employ their main residence in a 1031 exchange since such exchanges are reserved for investment properties or commercial buildings. Nevertheless, with proper planning and a suitable transition structure, it’s feasible to utilize a primary residence for a 1031 exchange.

Section 121 offers a primary residence exclusion for properties with dual purposes, aiding in mitigating capital gains tax on your primary home under Section 1031. For instance, if you possess farmland as an investment but live in the farmhouse with your family, it could qualify as both a primary residence and an investment property. Similarly, if you own a multifamily property, living in one unit while renting out the others could make it eligible for dual classification.

Understanding Capital Gains Tax

Understanding 1031 exchanges hinges on grasping capital gains and their accompanying taxes. According to the Internal Revenue Service, a capital gain or loss is simply defined as “The difference between the adjusted basis and the amount you realized from the sale…of a capital asset.” These gains emerge when proceeds exceed the initial investment in assets like real estate, furnishings, investments, and stocks.

Changing Primary Residence to an Investment Property or Vacation House For A 1031 Exchange

Let’s explore the possibility of transforming your main home into a rental or investment property. We’ll focus on both a single-family home and a three-unit family home to illustrate this process. While the tax code doesn’t specify a precise duration for holding the property as a rental, it’s recommended to lease it at fair market value for at least two years if you plan to pursue a 1031 exchange on the investment property later.

For a Single Family Home: You can convert your primary residence into a property compliant with Section 1031 by leveraging Section 121. After meeting the minimum holding period as a rental property, your primary residence is likely eligible for exchange under Section 1031.

For a Three-Unit Family Property: Transforming a three-unit home into a rental property with three apartments, where you occupy one and rent out the other two, is feasible. Utilizing Section 121 allows you to convert one principal dwelling into a 1031 rental property. Since you reside in one unit and rent out the other two, you can execute a 1031 exchange on those rental units.

Regulations to Observe

- Residence Requirement: To qualify for certain benefits, it’s necessary to have resided in the property for two or more of the preceding five years before making any changes.

- Capital Gains Exclusion: When filing taxes, individuals can exclude capital gains of up to $250,000 for single returns and $500,000 for joint returns, offering a significant advantage.

- 121 Exchange Limitation: The opportunity for a 121 exchange can be utilized only once within a two-year period, ensuring fair and regulated transactions.

Comparing Sections 121 and 1031

Certain actions are off-limits if you wish to fully benefit from the tax deferral advantages of a 1031 exchange for your main residence. Firstly, it’s not permissible to simply label your primary home as a rental property and include it in a 1031 exchange. Additionally, unless you own a multi-family property, you cannot designate your personal residence as a rental.

Use of Section 121

Under Section 1031, you have the option to delay payment of capital gains tax. Additionally, if you sell a personal property that served as both an investment and primary residence, you can exclude proceeds from taxation under Section 121. To qualify for Section 121, you must have lived in the primary residence for at least two years within the past five years.

Section 121 Functions

- Enjoy tax exemption: Utilize Section 121 for tax benefits.

- Utilize Section 121 once every two years.

- Couples filing jointly can exclude gains of up to $500,000 from tax liability, while single filers can exclude up to $250,000.

- Flexibility: It’s not mandatory for the time spent living in the property to be concurrent.

Requirements & Rules under IRC§ 121

The IRS Section 1031 outlines regulations allowing investors to defer capital gains tax through a 1031 exchange, provided the property served business or productive purposes, such as rental investments.

Conversely, homeowners can utilize Internal Revenue Code Section 121 (IRC §121) to defer capital gains tax upon selling their primary residences.

To qualify for the exclusion under section 121, homeowners must adhere to specific rules:

Also read this Post: BAGWORMS IN HOUSE

- Own the property for a minimum of two years out of the preceding five years before the sale.

- Utilize the primary residence as their main home during these two years.

- Demonstrate a bona fide intent to use the primary residence as their main home.

- The maximum exclusion of gain is capped at $250,000 for individuals and $500,000 for married couples filing jointly.

Furthermore, if multiple homes were owned within two years before the sale, there might be distinctive tax implications, necessitating careful consideration before proceeding with a deal.

It’s imperative to consult qualified tax advisors for expert advice on tax-related matters.

Section 1031 Functions

- Tax deferment: In order to postpone payment of capital gains tax, it is essential to reinvest all earnings from your transactions.

- Similarity requirement: Both replacement and relinquished properties must be held for commercial or investment purposes and must be of like-kind.

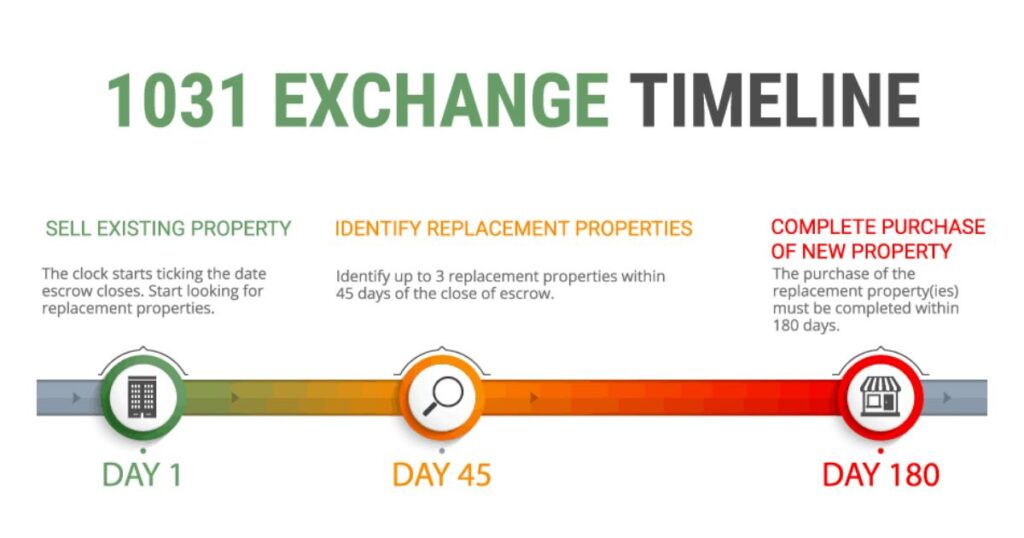

- Compliance regulations: The process of completing a 1031 tax-deferred exchange entails adhering to various regulations, including the 45-day verification period, the 180-day replacement period, and utilizing a certified intermediary.

- Unlimited usage: There is no limit to the number of times a Section 1031 exchange can be utilized.

- Boot taxation: Profits from boot, also known as sale profits, are subject to capital gains tax.

Timeframes for 1031 Exchanges

As per IRS guidelines, once the transaction for your old property is complete, you have a 45-day window to either secure a new property or formally designate one for a 1031 exchange. It’s crucial to identify replacement properties and choose a certified intermediary early on to ensure you meet these strict deadlines.

Once your old property is relinquished, you then have 180 days to purchase at least one replacement property to finalize the exchange. If you opt for more than three properties, their total worth must not surpass 200% of the value of your relinquished property.

Final Thoughts: Executing a 1031 Exchange on a Primary Residence

Although a 1031 exchange isn’t applicable to primary residences, there are alternative provisions to aid investors in deferring capital gains or losses. Thus, NNN Deal Finder emphasizes the importance of assembling a team of seasoned advisors.

Our mission is to educate, enlighten, and link real estate investors with reliable NNN Properties for sale, ensuring a steady stream of passive income. Proficient in 1031 exchanges, we provide comprehensive assistance from preparation to closure and beyond.

FAQ’s

How often can you do a 1031 exchange?

A 1031 exchange can be done repeatedly, as long as you follow the rules and deadlines. There is no limit on the number of times you can use this tax-deferral strategy.

What is the most common type of 1031 exchange?

The most common type of 1031 exchange is a delayed exchange, where you sell your relinquished property first and then have a set period of time to identify and acquire replacement property. This provides flexibility in finding suitable replacement property.

How do you calculate depreciation after a 1031 exchange?

To calculate depreciation after a 1031 exchange, you carry over the adjusted basis and remaining depreciable life of the relinquished property to the replacement property. The depreciation schedule continues from where you left off with the old property.

How do you calculate a 1031 exchange?

To calculate a 1031 exchange, you need to determine the net proceeds from the sale of the relinquished property and the purchase price of the replacement property. The gain is deferred to the extent the purchase price exceeds the net proceeds.